Don’t delay life experience for the dream of retirement

The Question That Changed My Perspective

I’ll never forget a conversation I had in my early 20s with a lifelong friend. While I was chasing dreams of learning languages, traveling, and gathering life experiences, he was busy building a business, accumulating wealth, and starting his career. As I shared stories of my adventures he asked me, “Don’t you want to retire someday?”

At the time, the idea of retirement was so far from my reality that I could barely grasp it. I don’t remember exactly how I responded—probably something like, “I doubt I’ll ever retire.” To me, the thought of earning “enough money to retire” meant sacrificing my freedom and youth to grinding away at a job. Instead, I chose to live frugally, prioritizing experiences over material wealth.

Is It a Mistake to Delay Your Career?

Fast forward to today. My friend has become very successful, and I’m genuinely happy for him—he’ll likely retire early. But what about me? Did I make a mistake? Did I miss my chance to build wealth and secure a cushy retirement?

If we measure life solely by retirement or the “American Dream,” where lifestyle creep and material accumulation measure our success, maybe I did. Otherwise, I am doing just fine!

What Makes a Life Truly Rich?

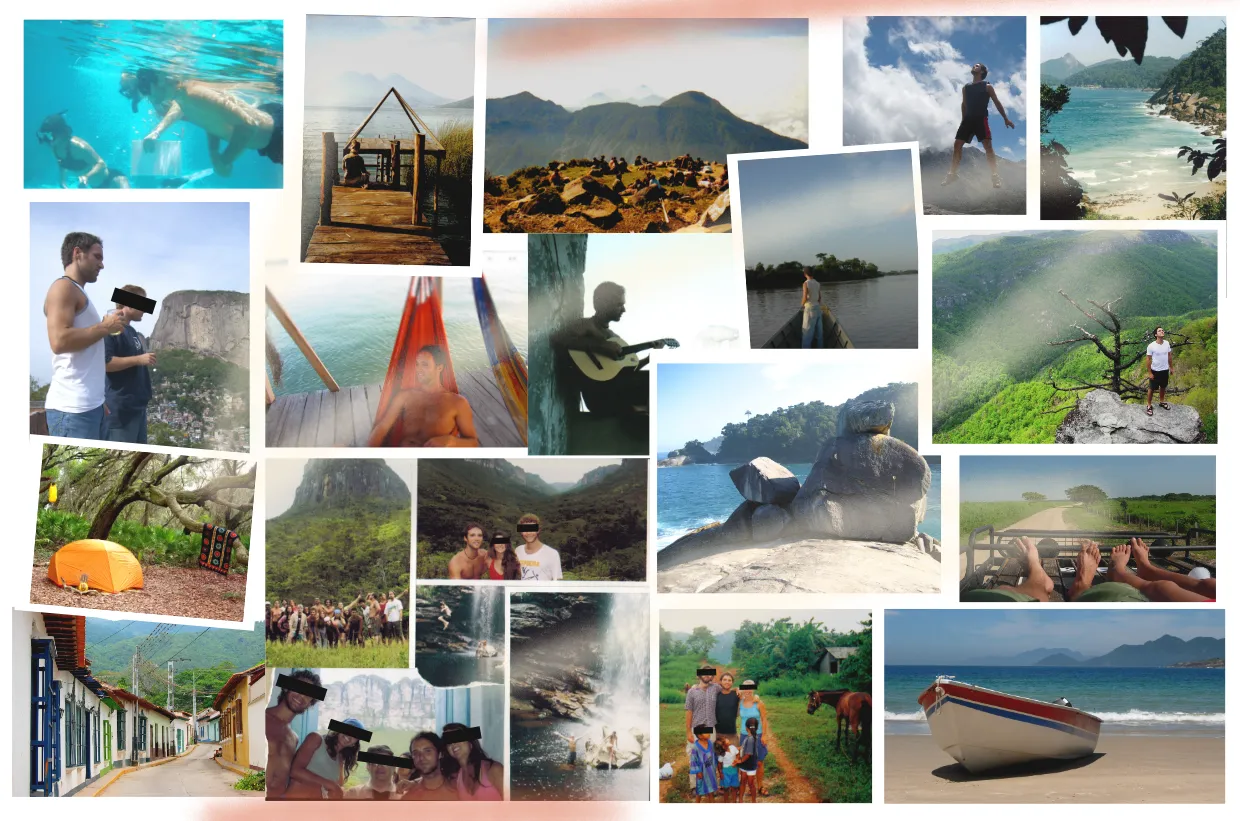

The greatest resource we have isn’t money—it’s time. Time to do the things we love, with the people we love, in the places that inspire us. I didn’t want to wait until old age to climb mountains, swim in seas, or fall in love. Could I have been smarter with my finances? Absolutely. Choosing a career at the age of 20 was very difficult for me. For some, jumping straight into a career is obvious or necessary. For me—at the time—front loading some life experiences over chasing the idea of the American Dream and retirement felt right.

It was only later that I stumbled upon the ideas of the FIRE movement (Financial Independence, Retire Early) when I began reading JL Collins’ blog out of sheer curiosity about investing in stocks. By that point, I wasn’t positioned to live as frugally as FIRE advocates suggest—family life had shifted my priorities—but the mindset stuck with me. It helped me resist the pull of lifestyle creep, even as friends and colleagues began to acquire all the “things” that often come after years of hard work.

Even now, investing in experiences remains at the heart of what I consider a rich life. We may not splurge on every consumer good, but when it comes to disposable income, it goes toward creating memories—especially as we raise our child. Whether it’s travel, quality time, or shared adventures, we choose to focus on the things that bring lasting joy and meaning.

A Rich Life Is Built on Experiences

Unlike material possessions my experiences can’t be displayed on a shelf. Most of my deep traveling experiences happened before smartphones and social media. But they’ve shaped my worldview, taught me resilience, and instilled a deep sense of curiosity. These are lessons and values that money can’t buy. I don’t regret a second of it—only look back with nostalgia.

Advice for the Young and Adventurous

If you’re young and have the opportunity, my advice is simple: go for the adventure. Take the risks. Gain the experiences. You’ll meet incredible people along the way and discover so much about the world—and yourself. Remember, your greatest resource is time.

Don’t wait to start living.